New beneficial ownership information reporting requirements came into effect on January 1, 2024 under the United States Corporate Transparency Act (CTA). The Act requires certain U.S. and foreign reporting companies to provide certain identification information on beneficial owners (BOI) to the Financial Crimes Enforcement Network (FinCEN)—a bureau of the U.S. Department of the Treasury. Significant financial and criminal penalties may apply for failure to file the disclosure.

The Act is intended to help prevent bad actors from laundering or hiding money and other assets in the U.S.

Are you considered a foreign reporting company?

A ‘foreign reporting company’ is defined by FinCEN as “a corporation, S-corporation, Limited Partnership, Limited Liability Partnership, Limited Liability Company, Business Trust or other entity formed under the law of a foreign country that is registered to do business in any state or tribal jurisdiction by the filing of a document with a secretary of state or any similar office.”

If your company has filed formation or registration documents with any state in the United States you may be affected.

Note: General Partnerships are not required to report BOI under the CTA as they are not registered legal entities.

Exemptions

Exempted entities include securities reporting issuers, governmental authorities, bank and credit unions, depository institution holding companies, money services businesses, brokers or dealers in securities, securities exchange or clearing agencies, other Exchange Act registered entities, Investment companies or advisors, venture capital fund advisors, Insurance companies, state-licensed insurance producers, Commodity Exchange Act registered entities, and accounting firms.

Beneficial Owner

Any individual who directly or indirectly exercises substantial control over the reporting company or who owns or controls at least 25% of its ownership interests (stock/voting) is considered a beneficial owner.

There is no limit on the number of individuals who may be treated as exercising substantial control over a reporting company.

Substantial Control

Even if an individual does not own or control at least 25% ownership interest, they will still be considered a beneficial owner if they:

- hold a management position,

- has the authority to appoint or remove any senior officer, or

- make or influence important business and financial decisions of the reporting company.

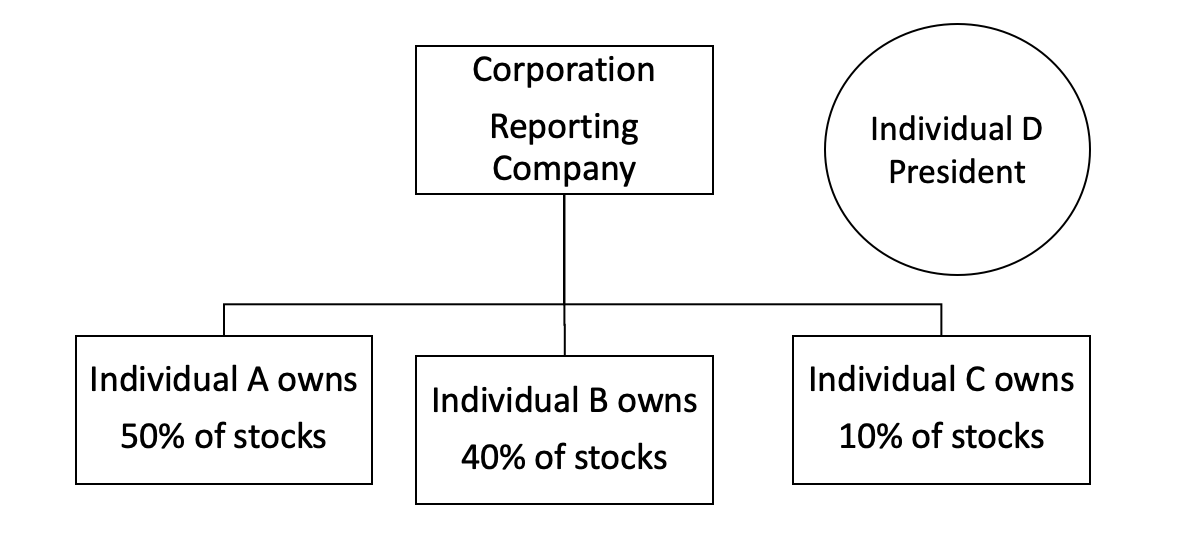

Example:

- Individuals A and B surpass the 25% threshold for beneficial ownership.

- Individual C, despite owning 10% of the company stock, falls short of the 25% threshold and does not exercise substantial control over the company.

- As President, Individual D exercises substantial control over the company, regardless of their ownership percentage.

In this example, Individuals A, B, and D would be considered beneficial owners of the company, and their information must be reported to FinCEN.

Reporting Deadlines

Reporting companies created or registered before January 1, 2024 have until January 1, 2025 to file their initial BOI report.

Reporting companies created or registered on or after January 1, 2024 and before January 1, 2025 are required to file their initial BOI report within 90 calendar days of incorporation or registration.

Reporting companies created or registered on or after January 1, 2025 will have 30 calendar days from the date of creation or registration to file their initial BOI report.

BOI reports should be reported within 30 calendar days if any changes are made to the ownership or management structure.

After an initial report has been filed, any updates need to be filed within 30 days of change.

Penalties

Reporting entities can face civil penalties of up to US$500 per day after their BOI reporting deadline for failing to provide complete and accurate BOI information.

A willful failure or attempt to provide false or fraudulent beneficial ownership information could even result in criminal penalties, including imprisonment for up to two years and/or a fine up to US$10,000.

A reporting company that is required to file a BOI report must do so electronically through BOI E-Filing portal at https://boiefiling.fincen.gov. We recommend that you consult with your legal counsel to assist you with the filing of the report.

S+C Partners is committed to helping you.

Our dedicated team of tax professionals includes experts in both corporate and personal US tax matters. Please call us at 905-821-9215 or email us at info@scpllp.com if you have any questions regarding U.S. Beneficial Ownership Information Reporting or any other U.S. taxation issue.

Looking for more tax information? Explore our comprehensive tax services. We also specialize in accounting, advisory and Information Technology. Explore our complete service offering.

Read our most recent Insights.

S+C Partners is a full-service firm of Chartered Professional Accountants, tax specialists, and business advisors with in-house expertise that extends well beyond traditional CPA services. In addition to audit, accounting, and Canadian tax services, we also offer business advisory services, comprehensive IT solutions, Human Resource consulting, and in-house expertise within highly focused areas such as US taxation, business valuations, and estate planning. We provide all the technical expertise of a large CPA firm, but with the personal touch and partner-level attention of a boutique accounting and advisory firm.